As we embark on another busy holiday season, it’s wise to review small parcel rates and deadlines from the three major U.S. carriers. This year, shippers will experience a unique set of challenges. The domino effect of the government shutdown on air freight and travel could lead to a strained supply chain into peak season. Flight cancellations, a weakened workforce, and reduced resources are likely to ground or redirect cargo shipments to alternative transportation networks with extended delays and increasing costs.

Tariffs on popular consumer goods including electronics and toys compound the holiday prices even further. UPS and FedEx have stabilized their general rate increases at just under 6% for the third year in a row. However, true increases range from 7% to 12% when factoring in the surcharges plus dimensional and zoning rates.

Here’s a summary of key small-parcel rate changes and holiday shipping deadlines for the 2025-2026 season (which you should use to plan ahead into 2026) for major U.S. carriers.

United States Postal Service (USPS)

USPS is applying temporary holiday surcharges ranging from $.30 to $16 on domestic parcel packages (Priority Mail, Priority Mail Express, Ground Advantage, Parcel Select) until January 18, 2026. Envelope increases range from $.90 to $2. These price increases on commercial and retail customers are in addition to existing shipping fees.

- Priority Mail Zones 1-4:

- $0.40 increase for 0-3 lbs

- $0.95 for 11-25 lbs

- $3.00 for 26-70 lbs (oversized)

- Priority Mail Zones 5-9:

- $0.90 for 0-3 lbs

- $3.25 for 11-25 lbs

- $7.00 for 26-70 lbs

With these increases comes a glimmer of hope. USPS has worked hard to turn its challenges around with facility investments and operational upgrades. According to their website, over the last four years the organization has invested $20 billion to modernize operations including 614 new package sorting machines, and automated scanning capabilities to increase visibility. They have also added nine new regional processing centers, 19 regional transfer hubs, 17 local processing centers, and 133 sorting and delivery centers to better serve customers all year round.

UPS

This year, UPS shortened the window for rate negotiations to 30 days, giving customers less time to forecast pricing structures. The new UPS rates will hold steady through Jan. 17, 2026, and will reach its highest pricing from November 23 to December 27, 2025.

Price ranges are based on volume deviations from normal activity and services used:

- Additional Handling on U.S. Domestic, Import and Export Shipments:

- $8.25 to $10.80

- Demand Surcharge on UPS Ground Residential, Air Residential, Air Commercial and Ground Saver Packages for qualifying customers (20,000+ packages):

- $0.40 to $8.75

- Demand Surcharge on UPS Ground Residential, Air Residential, Air Commercial and Ground Saver Packages

- $.040 to $2.05

FedEx

FedEx has introduced holiday rates that vary by service and date, running until Jan. 18, 2025. Peak season goes from Nov. 24 to Dec. 28, 2025.

- Demand Surcharge on Residential Ground Express Services on Residential Ground:

- $0.40 to $0.65

- Domestic and International Additional Handling Surcharge:

- $8.25 to $10.90 per package

- Domestic and International Oversize Charge:

- $90 to $108.50 per package

- “Delivery Area Surcharge” for U.S. residential package services

- $6.20 to $6.60 per parcel

These are in addition to handling, dimensions, residential/remote delivery fees, etc.

Amazon

New to our list is Amazon Shipping, who also will levy surcharges from Oct. 26 to Jan. 17. The highest rates are aimed at large, heavy, and additional handling charges. This year they removed the volume-based surcharge that was applied in 2024.

Depending on the ship date:

- Per Package

- $.40 to $.60

- Additional Handling

- $8.25 – $10.80

- Large Package

- $90 to $107

- Extra Heavy

- $485 to $540

Amazon’s fulfillment partners and other third-party sellers will see rates increase based on the product dimensions and price starting on Jan. 15, 2026.

Holiday Shipping Deadlines

- Domestic last ship-dates (for delivery by Dec 25):

- Ground/First-Class (USPS): Dec 17

- Priority Mail: Dec 18

- Priority Mail Express: Dec 20

- UPS & FedEx – 3 Day: Dec 19; 2nd Day Air: Dec 20; Next Day: Dec 23

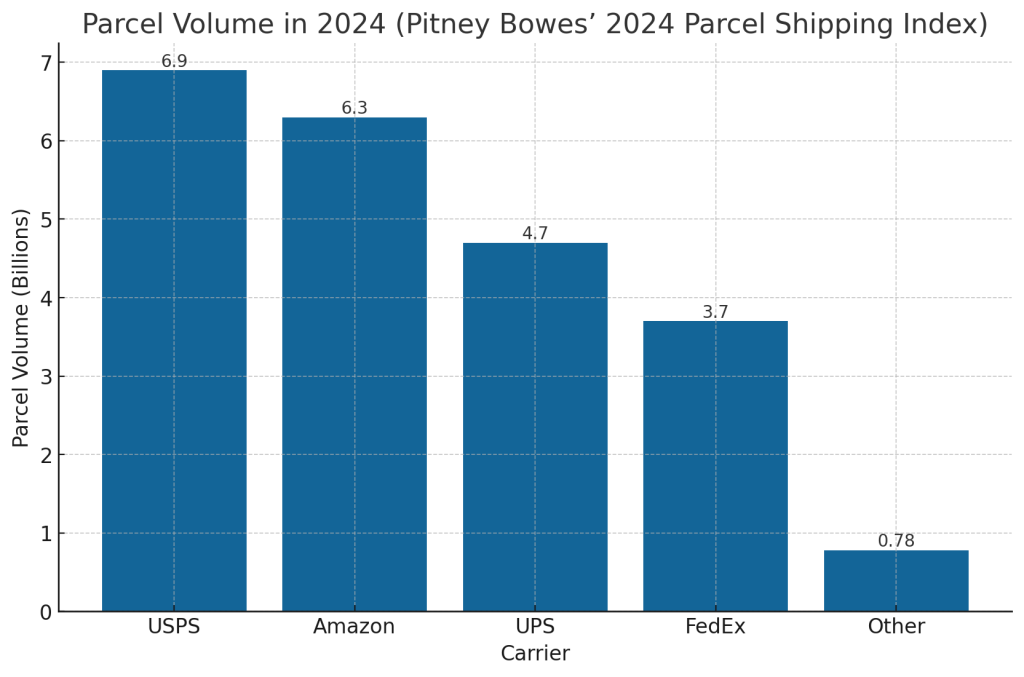

Pricing pressure during the holidays is here to stay. The shipping industry has diversified greatly over that past few years due to aggressive competition. Amazon is becoming a more dominant carrier recently, even on shipments that are not made through its website.

Parcel Volume in 2024 (Pitney Bowes’ 2024 Parcel Shipping Index)

- USPS: 6.9 billion

- Amazon: 6.3 billion (up by 7.3% since 2023)

- UPS: 4.7 billion

- FedEx: 3.7 billion

- Other: 780 million (up by 22.6% since 2023)

As we see new carriers gain more market share, it’s wise for shippers to develop a carrier rate analysis and negotiate their rates with volume data and dimensional data. Low to medium volume shippers can work with a third-party logistics provider to pool multi-customer volumes to gain the same advantage of larger shippers.