Foreign Trade Zone

Evans Distribution Systems operates more than 2.3 million square feet of General Purpose Foreign Trade Zone #70 in Metro Detroit. A Foreign Trade Zone (FTZ) is advantageous for companies involved in the import and export of goods.

Request Foreign Trade Zone Services

A Storage Solution Designed to Control Costs

A Foreign Trade Zone (FTZ) is a special economic zone in the US where imported goods can be stored, distributed, processed, and used without being subject to customs duties. Customs duties and excise taxes are due only at the time of transfer out of the FTZ.

What are the benefits of Storing goods in a Foreign Trade Zone?

- Relief from inverted tariffs

- Duty exemption on re-exports

- Duty elimination on waste, scrap, and yield loss

- Weekly entry savings

- Duty deferral

- Reduction of taxes and fees

- Zone-to-zone transfers

- Considered by customs to be CTPAT best practice

- No time limits to the length of storage in an FTZ

FTZs also improve supply chain performance through expedited processing, weekly entry and direct delivery from ports of entry.

What functions can be done in a Foreign Trade Zone?

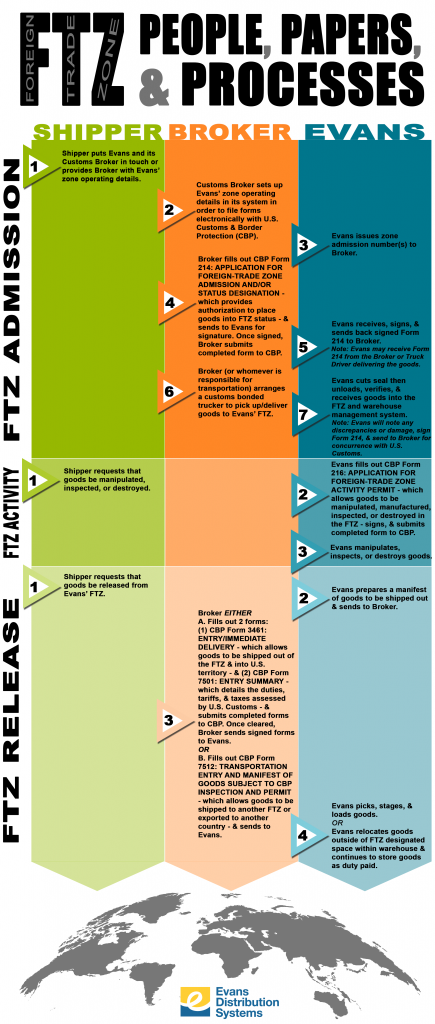

A variety of functions can be conducted in an FTZ including assembling, testing, re-work, cleaning, re-labeling, re-packing, co-packing with other foreign or domestic product, or destroying.

Are you a good fit for FTZ?

Any company that imports and pays duties is a good fit for the FTZ program. Ideally, the company is seeking duty deferral or duty elimination opportunities. They also want to reduce or eliminate duty drawback processes and expenses, brokerage fees and associated merchandise processing fees.

CASE STUDY

From Taiwan to the U.S.—Duty-free

What Our Customers Say

3PL Insights Blog

Evans Distribution Activates Foreign Trade Zone Across Seven Facilities

MELVINDALE, Mich., April 7, 2024 — Evans Distribution Systems, a full-service third-party logistics (3PL) provider of warehousing, transportation, fulfillment, value-added, and staffing solutions, has activated 378,000-square-feet of

Partnering with a 3PL for Value-added Services

Over the years, third-party logistics service providers (3PLs) have been utilized by companies to handle warehousing, transportation, and logistics services. Nowadays, 3PLs have evolved into

Benefits of Using a Detroit Warehouse

Location, location, location. Geography is an important factor when deciding where to store your products, and a question businesses must answer when they are trying